WHY APARTMENTS

Apartments have historically outperformed stocks & bonds

If you want to avoid high-risk investment, investing in apartments is a wise move. Multifamily investments can not only provide great equity growth, but they can also generate monthly income that is higher than what you would receive from bonds or stocks. This makes it a smart choice if you want to maximize your returns and minimize risk.

Multifamily investments have historically outperformed other Real Estate classes

Apartments are also the most profitable investment of all Real Estate Classes. Multifamily properties are able to generate significant cashflow and equity growth, which is why they offer higher returns than other real estate asset classes.

WHY APARTMENTS

Apartments have historically outperformed stocks & bonds

If you want to avoid high-risk investment, investing in apartments is a wise move. Multifamily investments can not only provide great equity growth, but they can also generate monthly income that is higher than what you would receive from bonds or stocks. This makes it a smart choice if you want to maximize your returns and minimize risk.

Multifamily investments have historically outperformed other Real Estate classes

Apartments are also the most profitable investment of all Real Estate Classes. Multifamily properties are able to generate significant cashflow and equity growth, which is why they offer higher returns than other real estate asset classes.

Take Advantage of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

- Standard or Straight-line Depreciation

- Accelerated Depreciation

- Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued for the preceding year.

Take Advantage of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

- Standard or Straight-line Depreciation

- Accelerated Depreciation

- Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued for the preceding year.

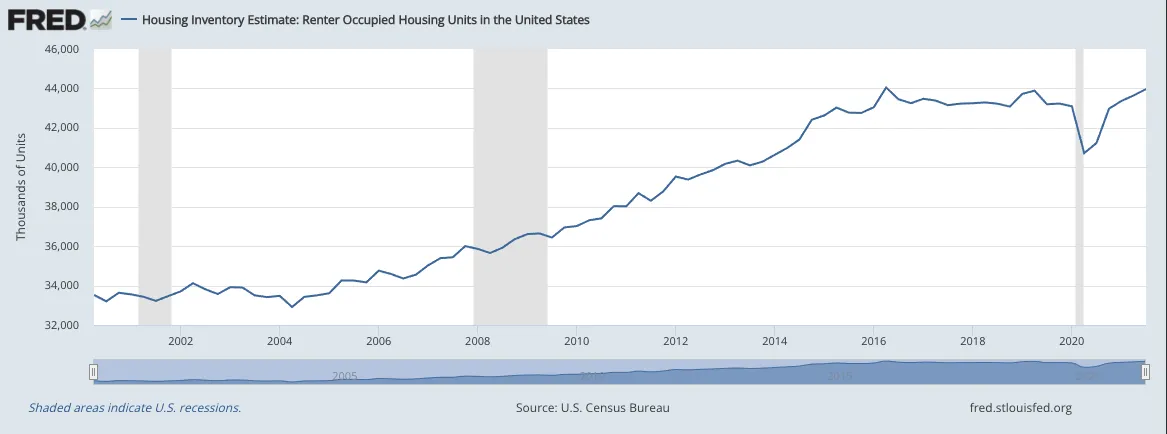

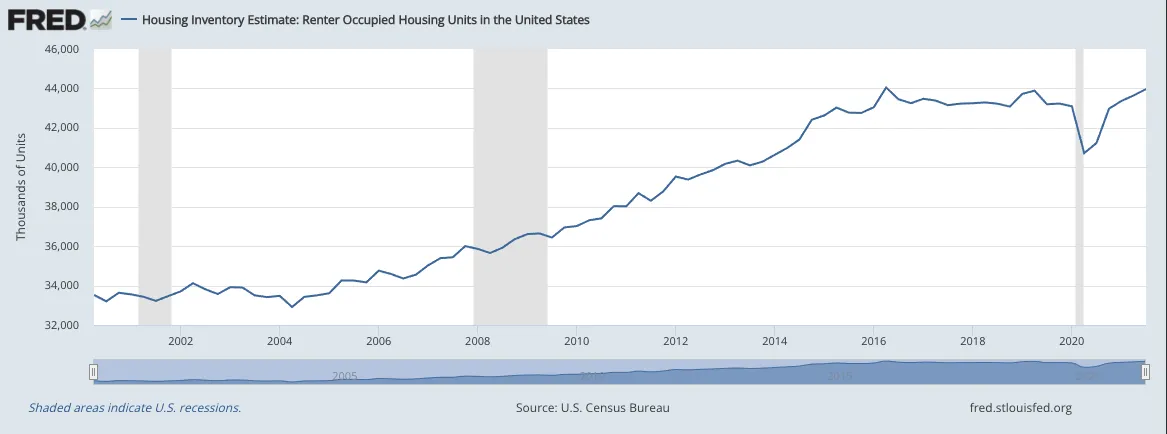

Demand for apartments is at an all-time high and still climbing

Home ownership peaked in the mid 2000s (see graph below), and has continued to decline since. Millennials and the aging boomers will want to be mobile in the 21st Century.

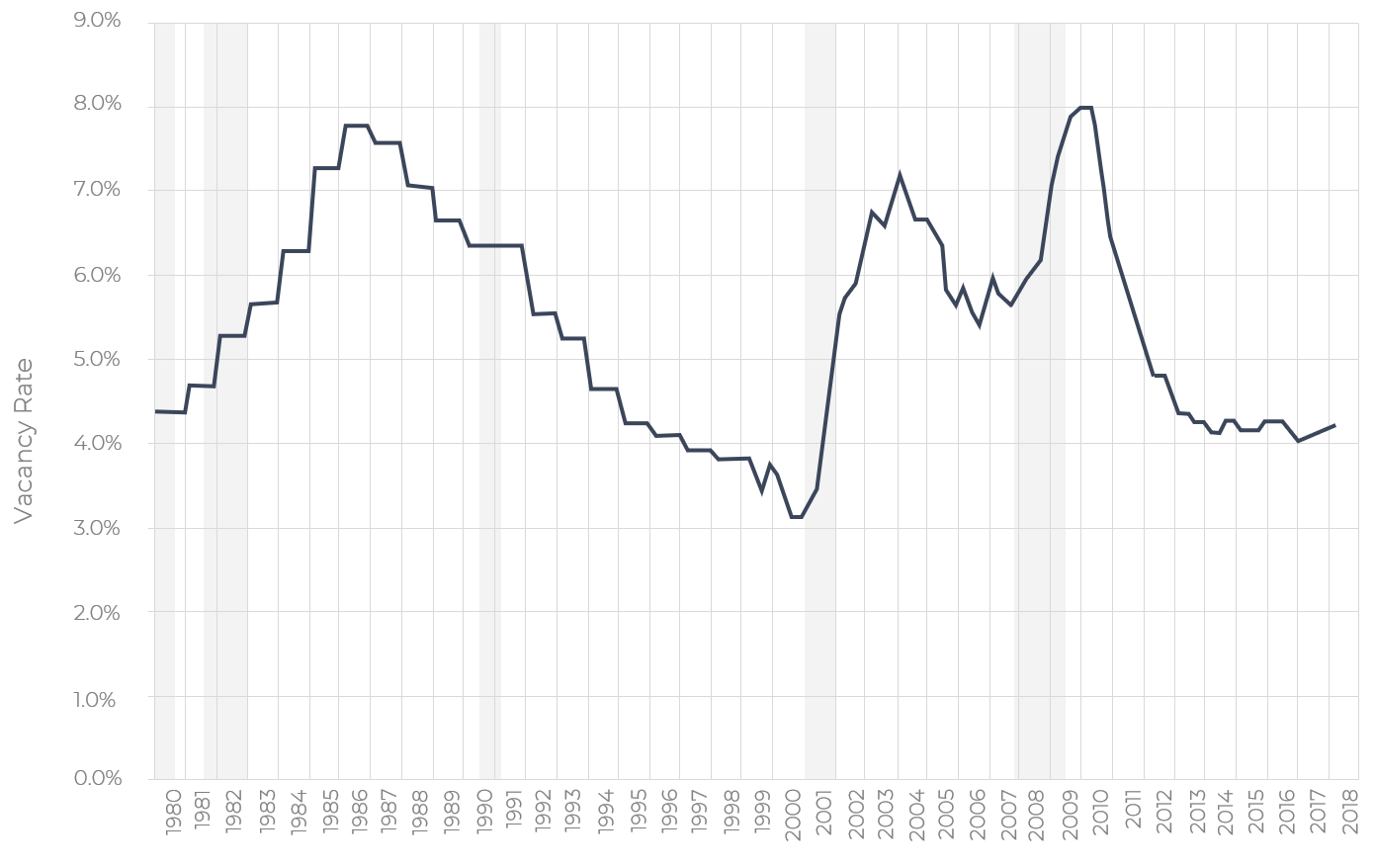

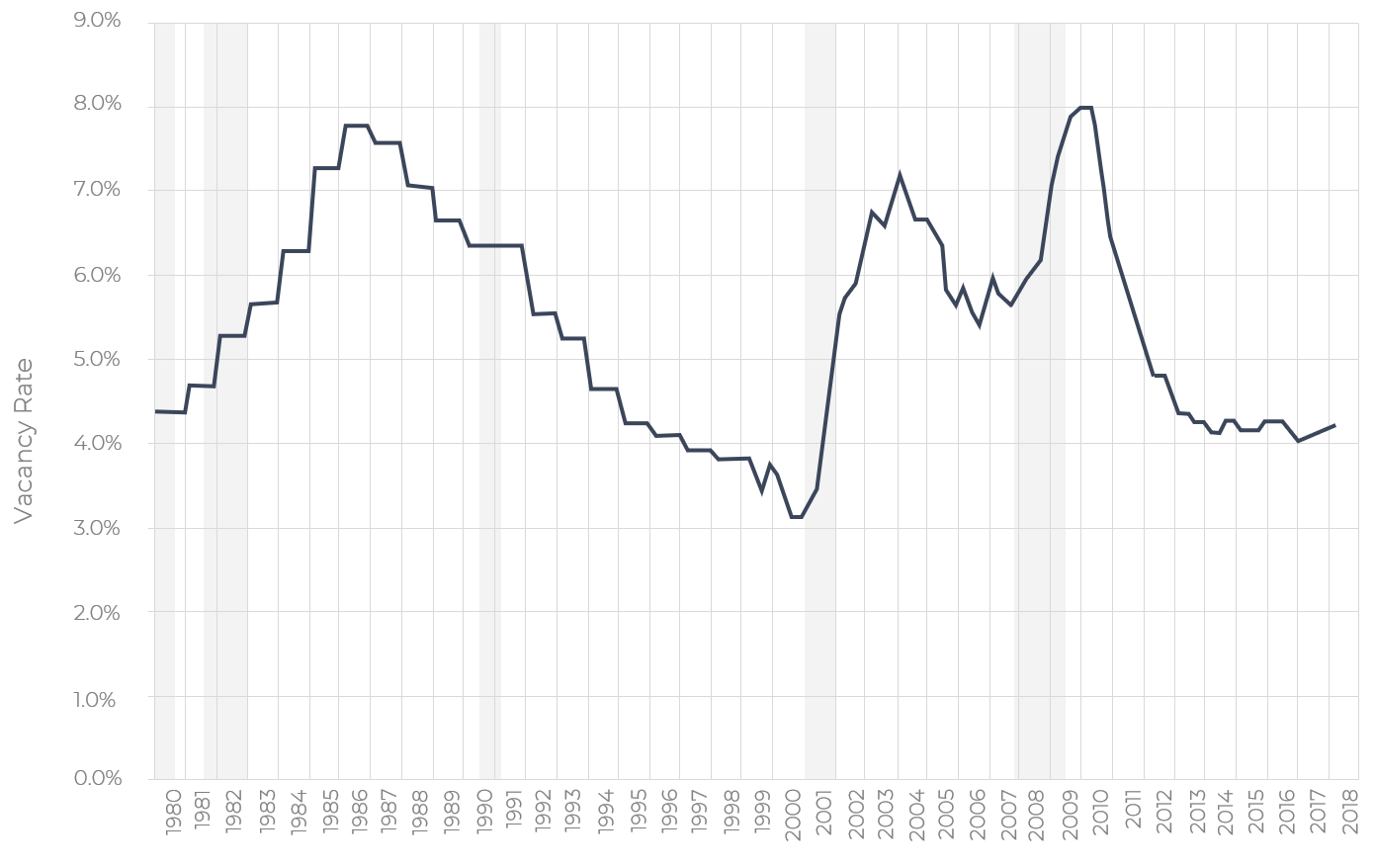

Vacancy rates remain low due to increased demand

The demand for apartments is increasing at an unprecedented rate, which means that apartment living is becoming more popular. A lower vacancy rate means more cashflow and equity growth which in turn means higher returns for investors.

Demand for apartments is at an all-time high and still climbing

Home ownership peaked in the mid 2000s (see graph below), and has continued to decline since. Millennials and the aging boomers will want to be mobile in the 21st Century.

Vacancy rates remain low due to increased demand

The demand for apartments is increasing at an unprecedented rate, which means that apartment living is becoming more popular. A lower vacancy rate means more cashflow and equity growth which in turn means higher returns for investors.

See for yourself why Investors love working with us!

See for yourself why Investors love working with us!

© 2022 BHR Real Estate Holdings All Rights Reserved. Privacy Policy | Terms of Use